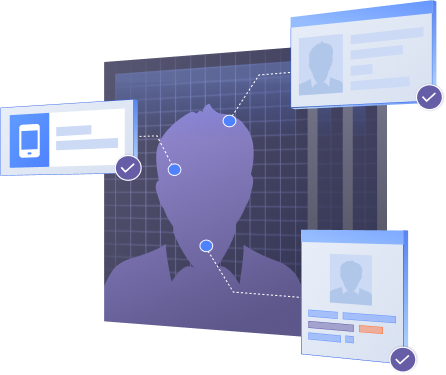

Implementation of "Know Your Customer" (KYC) and "Know Your Business" (KYB) procedures for new clients. These processes involve verifying the personal information of customers and legal entities, helping to prevent fraud and reinforcing trust in the system.

Continuous monitoring of transactions and customer behavior to identify and prevent suspicious activities related to fraud, money laundering, or terrorism financing.

Customization of risk assessment associated with each transaction or customer based on various parameters. This allows for taking appropriate actions to manage risks effectively.

Analysis of transactions in the blockchain to detect potentially risky or illegal activities, particularly crucial for cryptocurrency operations. Our system is integrated with one of the leading providers of this solution - Scorechain.

Automatic notification in case of detecting suspicious activities, as well as the preparation and submission of relevant reports to regulators.

Adherence to PSD2 standards and support for open banking principles, ensuring the security of financial operations and customer data.

Utilization of online questionnaires and surveys to gather additional information about customers, aiding in refining their profiles and needs, and enhancing the risk assessment process.